Silver Shore citizen, Jason requires

Is it possible you get a mortgage having a laid-back business? I have already been informed whenever brand new GFC this is exactly don’t possible. Is it real otherwise were there lenders one to fit informal teams?

Getting a loan due to the fact a casual worker isn’t as straightforward as if you were working fulltime, or even long lasting area-time.

There are lots of drawbacks so you can acquiring funds since a casual worker. To start with, your circumstances can vary week to help you week that may enjoys a visible impact on your income. Which definitely isnt finest, particularly if the period try less so you’re able to a place where you’re only coating earliest living expenses. In the extreme situations, the times was got rid of completely that may move you to get into the right position away from not being able to fulfill money.

Furthermore, once the an informal employee, you’re not permitted unwell get off or getaway leave. This may getting problematic especially throughout offseason and you may throughout minutes from very long periods out-of unanticipated problems.

They are the two fundamental affairs that loan providers dont view casual earnings in the same white because permanent earnings.

Just how is actually relaxed work defined?

Informal work actually defined by the a-flat amount of circumstances, or the absolute minimum number of period each week, the by definition itself. Whenever looking to financing, very lenders often request payslips to verify your revenue.

Payslips for all of us working on the an informal base will often have no regard to ill, or annual hop out. This isn’t always the case due to the fact payslips are different ranging from businesses, it are one way to influence the type off the employment and even if you might be eligible to hop out otherwise if you’re instances are consistent.

What about long lasting part-time?

Permanent part-go out try checked out in the same way since permanent full-big date income. Unlike everyday employment whenever you are long lasting part-big date, you happen to be generally guaranteed a specific amount of days a week.

In the place of relaxed a career permanent part-time employees are guaranteed a-flat amount of occasions each week. One circumstances has worked better yet is actually thought to be overtime, whereas relaxed team, merely get any hours did in the typical pay speed.

Think about hiring?

Of many builders has actually an arranged short term offer six or one year and you may usually work at a day rates. Delivering money as the a builder may vary anywhere between loan providers, since the for each anyone affairs are often quite some other.

Getting home financing while the an informal employee

One of the most significant pressures experienced to possess casual teams whenever seeking finance to possess a home, (except that movement within the earnings), is the fact that the of a lot loan providers require employment stability. Extremely loan providers require you to get into a career for during the least one year. Certain lenders accept six months.

At Mortgage Business i possess choice where you can get into an informal part getting as little as 3 months and still be able to get home financing.

With a reference out of your company is commonly recommend however it would not most transform one thing if you’ve simply been in your standing to have 90 days. Loan providers alternatively will a great deal more-thus at the genuine money over that step 3 times months, and then annualize you to definitely earnings.

Put simply, money would be confirmed possibly through seasons yet income shown in your payslip, or another way they could take action is through thinking about your own month-to-month financial comments and you can averaging the cash out over an effective ages of three months after which annualizing you to definitely contour.

Just how is actually borrowing from the bank ability influenced to possess relaxed employees?

Additionally, if you are operating 40 occasions weekly, full-time circumstances given that a laid-back, following usually the hourly price is higher than you might get into a permanent full-day income so if you’re constantly carrying out one to, after that your borrowing fuel is similar that have a complete-go out personnel.

What are the variety of everyday roles which can be checked-out more favourably?

The type of works you are doing doesn’t really matter anywhere near this much, but what loan providers usually takes under consideration try experience. So what can weigh in their favour is when you are employed in a particular field in which you’ve had earlier knowledge of a similar type of role before you begin your existing job.

However, for even relaxed instructors, specific loan providers might only annualize 40 days annually, or 42 months a-year cash, on account of college or university getaway periods where you wouldn’t be doing work. While which have a frequent relaxed employment, say from the merchandising area in which you could be functioning all the all year round, lenders you’ll annualize as much as 52 days property value earnings for each and every season.

Try rates of interest highest to possess casual personnel?

Interviewer: Okay. I am guessing that people one to make an application for finance having property mortgage, do you know the variations that have the individuals loan brands, Patrick? Carry out they have highest interest rates or do it be organized differently by employment method of?

While a casual personnel, you’re nevertheless qualified to receive an equivalent home loans that you would score just like the a long-term worker, provided your revenue is enough to qualify for the newest amount borrowed. There is no difference in terms of the options, cost otherwise costs.

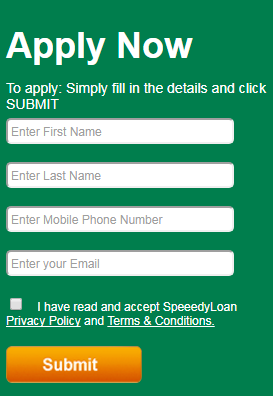

Obtaining a advance loan payday Colorado home loan while the a casual worker

With regards to what is actually expected to submit an application for a home loan, the high quality app procedure carry out pertain. Evidence like payslips and you will Pay as you go information on earlier in the day 12 months are often requested, but you will find some lenders which can as well as make sure income via lender statements that show income credits being received by the fresh account. Really loan providers although not, have a tendency to still wanted payslips and also the earlier in the day years Pay-as-you-go bottom line.

The bank have a tendency to determine income in different ways. Specific will annualize the latest payslip, established the year to date, provided there can be at least three months background exhibiting.

Someone else is going to do the same, and in addition examine it to what you obtained a year ago, and maybe do the down figure. It fundamentally utilizes the financial institution while they all have its own regulations and procedures.

Normally Mortgage Globe help me to get a loan given that a laid-back staff member?

We have entry to some choice and many differing kinds off loan providers which promote lenders and other traces off financing which might be specifically designed to have everyday professionals.

Patrick try a manager and a mortgage Specialist. He has got come helping Australians which have mortgage brokers since 2001. Before being employed as a mortgage broker Patrick was utilized by Macquarie Lender having 36 months and get has worked because an enthusiastic accountant having an openly noted business. Patrick’s official certification include:

Bachelor regarding Team, UTS Quarterly report. Majored during the accounting and you will sandwich-majored from inside the Funds and you can Product sales. Diploma regarding Money and you may Home loan Broking Administration FNS50310 Certificate IV inside Monetary Properties (Finance/Home loan Broking) FNS40804