You will find several methods improve probability of providing a mortgage, also improve probability of finding a minimal financial speed (that can allow you to buy alot more).

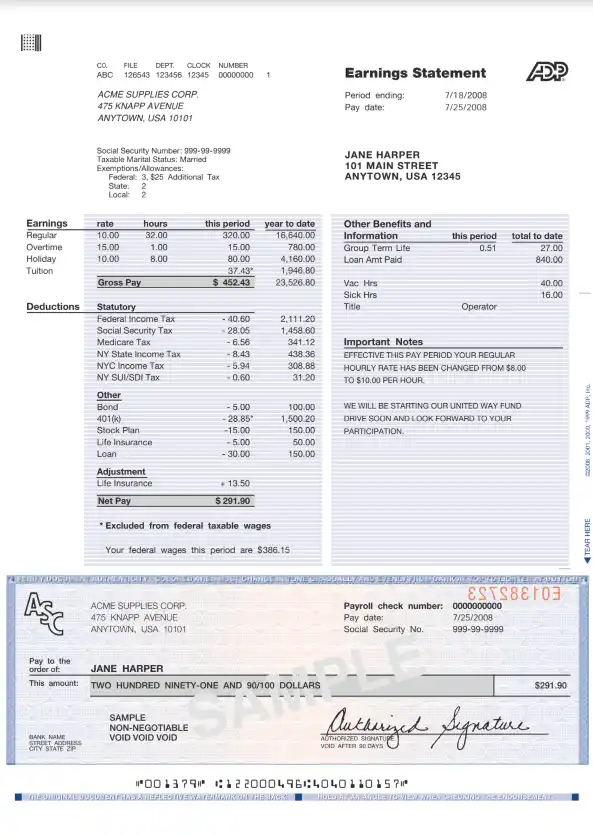

Understand the numbers, in and out. Are you presently investing your self an everyday salary? Do you realize their full team expenses and you can loans? What about your own monthly providers earnings? The loan pre-approval processes is smoother if you’re able to answer these types of issues in advance of ending up in a mentor.

Prevent your own write-offs. If you are thinking-functioning, there can be enough write-offs you can take in purchase to greatly reduce the tax accountability. To phrase it differently, it affects the debt-to-money proportion. By law, financial institutions must make sure to have enough money to help you qualify for your residence – so they will not be very flexible into the an from the books-type money plan.

A common misunderstanding we find from independent builders, is the fact that money they earn ‘s the money we’ll use in being qualified all of them, that is certainly untrue,” notes Minatel.

Keep the individual and you may providers accounts independent. It may be appealing to utilize your business account to spend to suit your personal requires or charge versa if it is just your running your business. Usually do not muddy the brand new seas financially – it generates they much harder on the financial to choose whether you actually be eligible for a loan.

Register and license your organization. Even though it is really not called for, it assists create easier for you in order to qualify. Registering a business just like the a different deal makes sense from a good qualifying view, due to the bad credit installment loans Delaware fact providers have a tendency to typically should be working to have during the minimum couple of years and you may you want proof of this,” advises Minatel.

However, the possible lack of taxable earnings towards guides causes it to be more complicated to obtain a home loan – it makes you appear to be you’re making less money than just you really are

Change your credit history. This really is always correct getting that loan – the higher the fresh new score, the higher their mortgage price, together with much easier its so you’re able to be considered.

Generate a much bigger advance payment. While you are financially able to, build a much bigger advance payment – it assists assuring lenders that you’re not likely to be an accountability, because your mortgage balance is lower.

Never accept even more loans during this time period. Lenders are wary about past-second alter towards financials; additionally you don’t want to chance moving the debt-to-earnings proportion above the limitation.

Hire a good CPA (Authoritative Social Accountant). You don’t need to having a CPA whenever qualifying to own a home loan. But not, it might make something more standard, such as toward independent builder that have an intricate tax condition, shows you Minatel.

Which are the Most readily useful Lenders to have One-man shop Anybody?

It certainly is best if you research rates to numerous lenders – and you may inadvisable to only go to your bank and you can take on any kind of financing provide they provide. Someone can visit about three other loan providers and you may become away which have three a little different also offers. But though anybody will give you a loan price that is .1% better than the next bank, which is often the same as thousands of dollars along side lifetime of your loan.

“Typically, all the lenders will probably accessibility the new independent designers money the same way,” says Minatel. “They want to do not choose specific specialities otherwise enterprises (independent contractors) over others.”

Houwzer’s home loan group do new shopping around so you’re able to loan providers to you, helping you save day when you are taking a customized mortgage service. In place of most loan officials, that are repaid a fee, Houwzer’s home loan advisers is actually salaried – making sure its desire is found on obtaining the most useful mortgage you’ll to you, in lieu of interested in the finest loan because of their paycheck.