A different survey away from Freddie Mac computer shows that Age bracket Z – People in america within chronilogical age of 14 and you may 23 – try dedicated to becoming property owners. Also so much more upbeat about any of it than its millennial cohorts had been on their age.

In reality, almost all faith they will very own a home by the chronilogical age of 29 – 36 months younger than the newest average earliest-day homebuyer ages.

- 86% off Gen Z really wants to very own a house

- 93% select homeownership given that something you should getting pleased with

- 88% state it offers versatility and you may handle

- 86% see it just like the a sign of triumph

When the anything was to stand-in the way in which of the homeownership requirements, Gen Zers mainly concur it’d be money. Depending on the questionnaire, Gen Z observes their biggest obstacles as home values, down costs, and you can jobs imbalance.

Building the origin to have Homeownership

Thankfully, Gen Zers’ futures commonly place in brick – and there is enough time to score those finances in balance in advance of year 30 rolls around.

Are you among an incredible number of Gen Zers that have homeownership with the brain? Here’s how to create yourself up to achieve your goals:

Speak with an economic professional.

This can be probably sound a tiny early, particularly when you’re on younger avoid out of Gen Z correct today, however it is really never ever too-soon to meet up with an economic mentor. If for example the parents keeps their own advisor, it may be as easy as asking them to bring you in order to an appointment with these people.

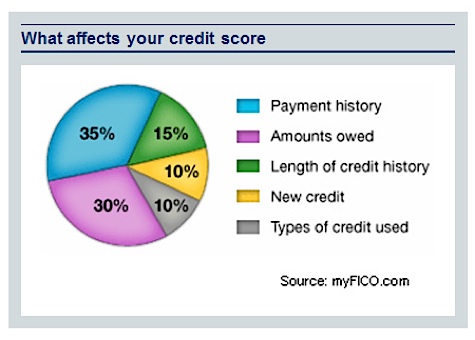

Why thus in the future? Borrowing from the bank performs a huge character regarding mortgage procedure, additionally the ideal your credit rating, the higher the possibility try to be recognized getting a home loan and buying property. Your own history which have credit (i.elizabeth., the https://paydayloanalabama.com/ridgeville/ size of the membership/the length of time you’ve had them unlock) accounts for whenever 15% of one’s complete credit score – and strengthening your borrowing from the bank takes time and energy. Should you get good professional’s advice about wise an easy way to start building the credit today – and you also follow up for the next years or more – you might enter an excellent condition as you prepare in order to become a resident.

Avoid much more credit (and take towards much more financial obligation) than just you need.

Because you may have a credit card does not always mean you have to use it. Become wise about when you use credit cards otherwise mortgage, and only take action when essential.

- View the debt-to-money ratio. Your debt-to-income ratio ‘s the percentage of your earnings you to definitely goes toward paying a myriad of obligations. When you apply for a home loan, your own financial will at your loans-to-money proportion to determine how much cash family you’ll pay for.

- Keep balances reduced. Pay back the expenses few days immediately following times, and do not let one to harmony creep up on your.

- Get rid of your figuratively speaking.Student loans causes it to be more complicated to buy a home. Take out just what you need, and envision working as a consequence of college to fund lease, debts, or any other expenditures.

Remove your credit score per year.

You’re eligible to a free of charge credit file after annually, so make the most of they. Once you remove they, you ought to

- Aware the credit bureau of every mistakes the thing is. It can help your credit score.

- Await accounts that you do not know . It could imply you happen to be a sufferer regarding id theft.

You get you to definitely free report from all the about three credit bureaus per year, so you could need to pass on all of them aside. Check out AnnualCreditReport to get your very first one to today.

Fool around with technology for the best.

You will find loads of development which can help you conserve money, make your credit, and easily get property. Most of them try free, also.

If you find yourself having difficulty saving upwards to possess a down-payment, these power tools makes it possible to lay your goals, manage your currency, and maybe stow away a manageable amount of cash throughout the years.

Work to comprehend the home loan processes.

Finally, take care to learn about mortgages, also what qualifying requirements you’re going to be stored to help you immediately following your submit an application for you to definitely. If you like help, reach out to home financing expert within Accept Home loans today. We are going to walk you through the procedure, therefore the credit rating, deposit, or any other criteria you’ll need to fulfill one which just buy a house.

Interested in learning how much cash home you really can afford? We could assist truth be told there, also. Just text Be considered in order to 22722 to see if your pre-qualify for a mortgage.

Advice within this [current email address, article, etcetera.] start around website links otherwise sources in order to 3rd-cluster information otherwise stuff. Incorporate Mortgage brokers will not endorse or ensure the reliability out-of that it 3rd-team suggestions. If you realize this type of hyperlinks, you will be hooking up so you’re able to a third party website not manage of the Embrace Mortgage brokers. We are really not accountable for the message of that website and you will its privacy & cover formula may differ from people experienced by the Embrace Lenders.