Contrasting Va Renovation Money

About funding choices for purchasing an effective fixer-top otherwise remodeling a property, Virtual assistant reong Pros and you will provider participants. This type of fund, called Virtual assistant rehab finance, offer many perks such as for instance capital renovations, zero advance payment specifications, and you may competitive rates of interest . Inside point, we shall speak about the distinctions anywhere between Virtual assistant restoration funds and conventional Va funds, along with other capital options for home improvements.

Variations from Old-fashioned Va Finance

Virtual assistant restoration finance are especially designated for improvements and fixes off a property, if you’re old-fashioned Virtual assistant funds are used for many different aim, for instance the purchase of an alternate household or refinancing a preexisting financial . The main advantageous asset of Va repair funds ‘s the ability to move the cost of the house therefore the can cost you of one asked fixes otherwise improvements to your one single financing and you will fee. The total amount which are often financed hinges on the newest projected “as-completed” value of the house influenced by a good Virtual assistant appraiser.

Other Investment Options for Renovations

In the event the an excellent Va rehabilitation mortgage isn’t the right complement, you’ll find solution an effective way to finance the purchase of a great fixer-higher or re-finance and you may fix a house. These possibilities become:

- Virtual assistant Energy-efficient Mortgages: This type of financing accommodate the financing of energy-productive upgrades to property, that will bring about discount over time. These types of upgrades are priced between solar panels, insulation, otherwise time-productive equipment.

- Va Bucks-Away Refinances: Pros can refinance its current loan and probably capture cash out on the security to cover home improvements. This 1 will bring autonomy in the with the collateral gathered within the our home.

- Specifically Adapted Construction Has: For Veterans which have provider-linked disabilities, specially adjusted housing offers are around for assist loans adjustment in order to make a house available and you may suitable for their demands.

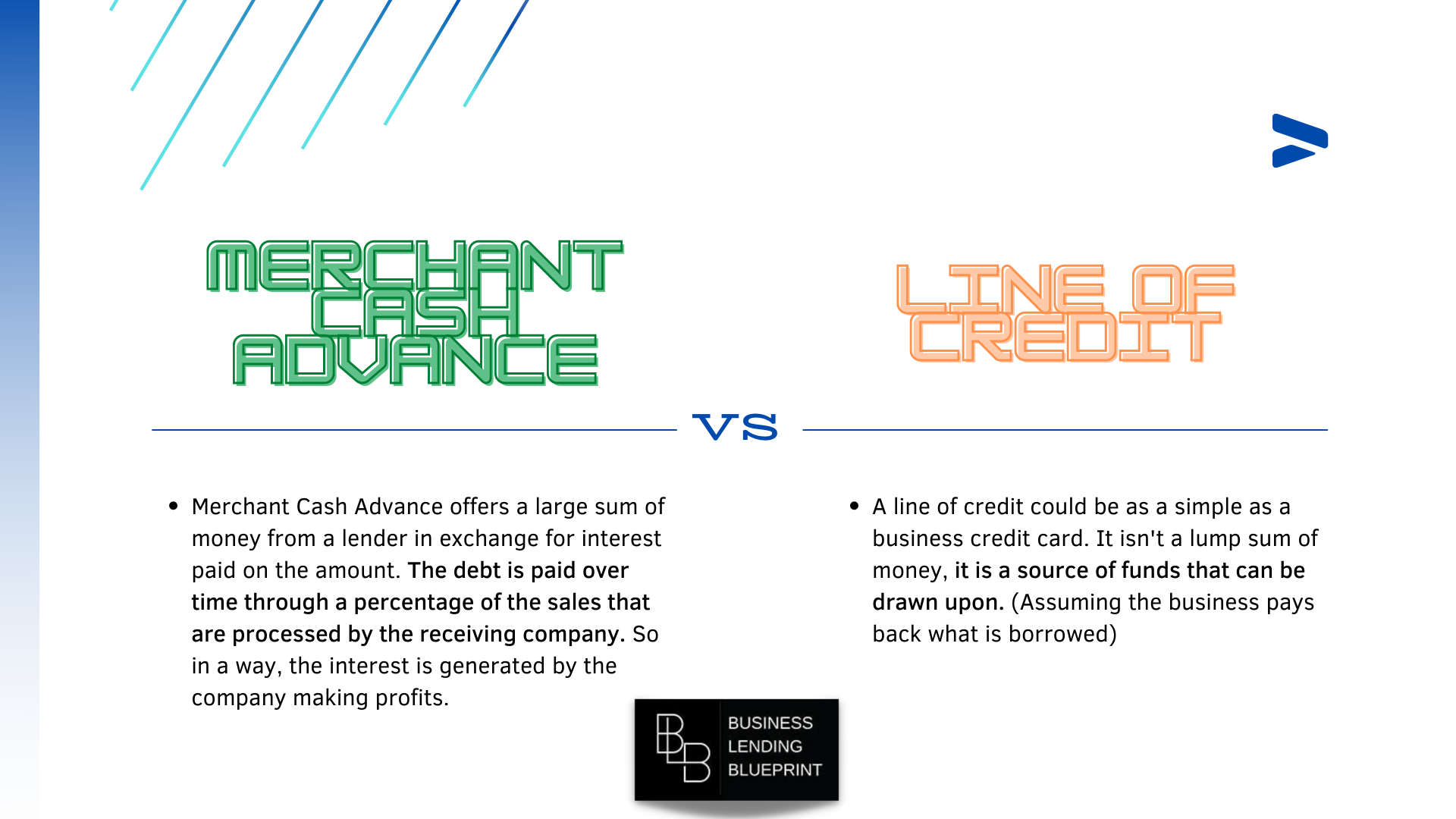

- House Collateral Finance and you may Family Collateral Personal lines of credit (HELOC): These types of choice ensure it is homeowners so you’re able to borrow secured on this new guarantee in their house to fund home improvements. Domestic guarantee funds give a lump sum, when you find yourself HELOCs offer a line of credit that can easily be drawn on as required.

- FHA 203(k) Loans: The same as Virtual assistant renovation money, FHA 203(k) finance accommodate the purchase or refinance out of a home that have the latest introduction off fix will cost you in a single mortgage. Such funds is actually insured by the Government Housing Administration (FHA) and will be utilised by one another first-date homebuyers and you will present residents.

Investigating such alternatives can help people discover the most appropriate resource provider centered on their own items and you can restoration desires. It is essential to talk to lenders and you will discuss this standards and you may benefits associated with for each option.

Because of the researching Va recovery funds to antique Va finance and you can considering other capital choices, someone can make informed decisions regarding your ultimate way to finance their property developments. Whether it is compliment of a good Va restoration financing or other investment opportunity, residents can also be open the chance of the dream domestic when you’re enjoying the advantages and you can help offered to all of them.

By conference the brand new qualifications conditions and you will appearing high enough borrowing and you will provider requirements, borrowers can qualify for a good Va re house. You will need to consult with a reputable financial whom focuses on Virtual assistant repair financing to be certain a flaccid and you may effective application for the loan processes.

You should remember that luxury updates and you may certain detailed systems might not be protected by the new Virtual assistant repair loan. However, getting qualified renovations, the mortgage allows borrowers to incorporate repair will set you back in one financing, giving a convenient and you will smooth resource solution. By leveraging the fresh new Va restoration mortgage, individuals can transform property in their dream domestic when you’re nevertheless experiencing the benefits of an individual mortgage.

By following the new distribution criteria and maintaining unlock lines out-of interaction having contractors and you will lenders, borrowers is also browse the new Va recovery financing procedure properly. That it collective approach implies that the fresh new renovation endeavor proceeds effortlessly and you can causes the fresh sales out of a loans East Brooklyn CT house towards an aspiration house having experts and you will effective-duty provider members.