Kapadokya Vip Transfer

Plan Your Journey with Luxury and Comfort!

Discover amazing places at exclusive deals

Luxury and Comfort Combined

Our VIP vehicle fleet is carefully selected to offer luxury, comfort, and safety. Equipped with modern features and regularly maintained, our vehicles ensure a seamless and enjoyable travel experience.

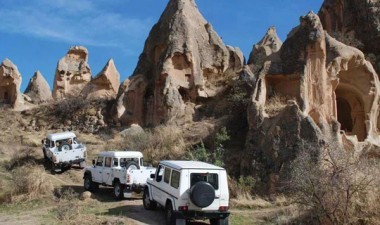

These unique locations are waiting to be explored!

Discover the charm and beauty of popular destinations. Each location offers unique experiences, ensuring unforgettable memories on your journey.

Comfortable and Reliable Transfer Service

We combine your transfer needs with luxury and comfort. With professional drivers and modern vehicles, we provide a safe, punctual, and stress-free travel experience.

Kapadokya Airport Transfer

Available Vehicles

- Mercedes Sprinter - Price: 3000.00 €, Passengers: 15, Gear:

€70

Kayseri Airport Transfer

Available Vehicles

- Mercedes Sprinter - Price: 3000.00 €, Passengers: 15, Gear:

€70

Istanbul Airport Transfer

Available Vehicles

- Mercedes Sprinter - Price: 3000.00 €, Passengers: 15, Gear:

€70

Hotels

Tours

Delivering Quality at the Best Prices!

Easy & Quick Booking

Your journey is just a few clicks away!

Seamless and Reliable Transfers

Experience stress-free travel with our punctual and professional service!

What our customers are saying us?

Real experiences from satisfied travelers!

2k+

Happy People

4.88

Overall rating

Your Travel Journey Starts Here

Sign up and we'll send the best deals to you